As with all industries in China, the wine industry moves at a dynamic pace. It is not just the volume of consumption that changes from year to year, it’s the market trends too. The fast moving market environment presents a wealth of opportunity for some, but for others that may not be the case. Although there is nothing absolute about the wine industry in China and the current global situation remains quite uncertain, the one thing that has been seen over recent years is the growing interest in taste and variation in foreign wines. Let us explore past and current trends in the market, the major players and how foreign producers can get their wine on a shelf in China.

Historical Wine Trends in China

Only since the early 80’s have foreign companies been permitted to invest in the wine industry in China. Historically, China has been a rice wine country, as opposed to grape wine. From as far back as the Three Kingdoms Era to up to as little as 30 years ago, grape wine was considered a luxury product and as such, was reserved for only the select few that could afford it.

China began to open its economy in 1978, opening sectors gradually in order to ease in economic reform. The next 20 years were characterized by various reforms, allowing for greater foreign investment. With an increasing demand for goods in the 90’s, the importation of certain goods became necessary. Wine was one of the goods for which there was a demand, a demand that was continually increasing. It increased at such a rapid rate, resulting in an oversupply of mostly low quality domestically produced or imported wine.

The Asian crisis in the late 90’s had played a large role on all economies in Asia, including the Chinese market in the following years. However, this period was said to bring about a sense of reason amongst consumers to become more aware of the quality of the imported products, including wine.

Fast forward a few years, with the entry of China into the World Trade Organization in 2001 a larger amount of producers were able to import their wines to China, as a result of bilateral agreements and reduced tariffs. The rising middle class in the 2000’s meant that consumers were able to afford more luxury goods. Thus foreign wines began to enter the market a rapid pace.

With the increase of western influence, Chinese consumers had taken greater interest in wine and started to become more knowledgeable on the craft. More expensive and well known wines were highly sought after.

While consumption in traditional wine consuming countries remains quite static, the consumption of wine in China is continuing to increase. Today China holds the highest wine consumption growth rate in the world.

In 2013, China had been ranked 5th in total consumption of wine, only behind the US, France, Italy and Germany (Statista). In 2014 China had surpassed France in total red wine consumption. While the USA has established itself as the leading red wine consumer in the world, it is predicted that China will take over is the world’s leading consumer before 2030 (CoFace Economics Publication).

Recent Consumer Trends

As China shifts from a manufacturing based economy to a consumer based economy, a new generation of Chinese consumers is emerging. These consumers have more disposable income and are becoming increasingly aware of high quality products. Drinking wine is now seen as a symbol of a certain desired worldliness that alludes to sophistication, status and wealth.

Wine producers around the world are becoming increasingly aware of this and as such more players are entering the market each year. In the coming years, producers in the top wine producing countries have everything to play for. With the correct taste, approach and market strategy, producers from any particular region could find themselves with a sizeable portion of the market share.

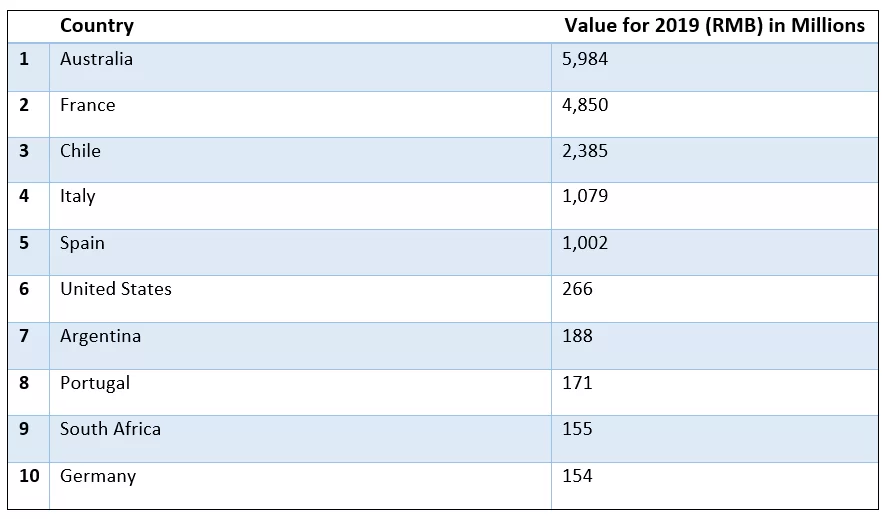

The top 10 countries with the highest import values for 2019 are:

(Source: OeMV on behalf of the Professional Organization of Wines from Spain)

The Rise of the Bubbles

Wine in China has mainly gained popularity through still wine, however there has been steady growth in the importation of sparkling wine over the past 5 years. Figures show an increase from 384 million RMB in 2015 to 579.5 million RMB in 2019, indicating that sparkling wines are increasing in popularity (OeMV). Still wines remain the far more dominant of the two, accounting for around 90% of the value imported into China (OeMV).

What’s What: Trends Among China’s Top Wine Importers

Australian Wine

For a long time, the Chinese consumer wine market for foreign wines was dominated by French wines, with Australia lagging behind. As consumer’s taste and knowledge of wine developed, they became more open to wines from other countries like Italy, Chile and Australia. An opportunity was then created for producers to enter the market and win over the hearts of consumers, an opportunity seized by Australian wine producers.

Australian wine quickly gained momentum, with China becoming Australia’s number 1 destination for wine exports. In 2019 a new era had begun when, for the first time, Australian wines had surpassed French wine imports in terms of volume and value of wine imported.

The breakthrough that was seen by Australian wines had arisen through a combination of factors. While there were some high end brands that were recognized, such as Penfold’s, there was a great deal of effort that went into educating Chinese consumers about the diversity of Australia’s wine and the various regions. Over time, Chinese consumers became more familiar with Australian brands versus brands from other countries.

Another major factor was the China-Australia Free Trade Agreement (CHAFTA),which China and Australia had entered, and came into effect in December of 2015. This bilateral agreement afforded a large number of Australian companies’ better access to the Chinese market. The signing of this agreement was a major blow to European wine, as Australia and Chile were able to import their products with zero tariffs, reducing the prices of their products significantly. The combination of better awareness and the low import tariffs, gave way for Australia to overtake France and bring an end to the dominance of French wine imports.

Despite a great deal of global economic uncertainty, the trend of Australian wine being the most imported by volume and value continued into 2020.

However, in the middle of 2020 Chinese authorities launched an investigation into Australia’s wine industry accusing them of violating anti-dumping rules. The accusation sent a shockwave through Australia’s wine industry, as this could cause complications with the zero tariffs trade agreement, which may lead to a hike in import prices and as such may draw a fast conclusion to Australia being the number 1 importer of wine to China.

French Wine in China

For a long period of time, in slowly maturing market, French wine was the default purchase for most Chinese consumers. For more than 2 decades the wines of Bordeaux had been the most well-known across China, illustrating just how influential and dominating French wines were. A survey by Wine Intelligence revealed that Bordeaux had an awareness rating of 52, eclipsing even the most well-known local wines.

French producers and distributors have done an outstanding job in not just selling French wine, but also selling a lifestyle. French wines had become the symbol of sophistication and prestige in China.

However, a new day has dawned and competition has become fierce. With both Australia and Chile having trade agreements with China, their import tariffs were reduced to zero, making it difficult for French producers to compete with the prices of their competitors.

All hope for the French wine industry is not lost, as they still remain the second most imported by volume and value. Furthermore, the new number 1 importer to China, is predicted to experience difficulty in the latter half of 2020 and possibly into 2021.

Although French wines are no longer the highest imported wine by volume, their value still remains high as Chinese consumers still view French wine as sophisticated. Therefore, even though the volume imported is significantly lower, the value of the imported wine still remains high, which is promising for French producers.

While the first chapter of French wines in China was heavily focused on the prominence of Bordeaux, the second will have to be focused on the variations and differences each region has to offer. Greater efforts have to be made in the education and promotion of the wines lesser known than Bordeaux. For instance, Champagne had seen a 9.1% increase in exports to China from 2018 to 2019 (CNBC), and Rosé was also seen by experts as a strong area for growth (Sopexa); indicating the opportunity for variations despite the recent surge of competition.

Chilean Wine in China

Chilean wines have excelled in the Chinese market in the latter half of the 2010’s. With Chinese consumers becoming more mindful of the price and taste of wines, they are steering away from persistently buying the same product and are more willing to embrace different variations.

Chilean wines have not always experienced success in China, as they had to battle the misconception that Chile only produced cheap wines. Through great effort by producers and the Chilean government, a large amount of resources were directed to educating Chinese consumers on the complex and fruity flavors Chile has to offer.

Similar to Australia, in 2016 China became the most important export market for Chilean wines, overtaking the US and UK. With the China-Chile Free Trade Agreement in effect from 2006 and the ongoing development of consumer preferences, Chile was able to gradually increase the amount of exports and value of the exports of wine to China. In 2010 Chile had exported just above 55million liters, while in 2019 they exported 154 million liters, indicating that they had managed to almost triple their yearly export volume in the space of 10 years (OeMV).

With Australia now experiencing trade complications with China and Chile still maintaining low tariffs, in comparison to their European counterparts, now may be the time for Chilean wine to not only catch up but perhaps surpass their competitors.

Other Wines in China

The constantly growing appetite for new varieties of wine is forcing consumers to look beyond options that were initially popular. An opportunity is emerging for wine makers from Italy, Argentina, South Africa and Spain, to occupy a larger share of the unequally balanced market.

Italy produces more than a quarter of wine in the world and has around 60,000 wineries (ChinaDaily). Among these are a large number of small wineries, with an array of complex tastes, that present the consumer with a unique cultural and personal experience. While Italian winemakers are faced with high taxes and tariffs when entering China, there is hope that it may be reduced in the future. While the volume of Italian wine imported has only increased by just under 10 million liters since 2015, the value has almost doubled, indicating that despite an increase in price, Italian wine is increasing in popularity.

Spain has for a long time had a presence in the Chinese wine market. Since the early 2000’s Spain had been importing a higher volume of wine than any other country, however over the years their imports were erratic, often increasing and decreasing from year to year. Spanish wine is still yet to see consistent growth over a sustained period. A turn of the tides could be seen, because in 2019 several leading wineries had opted for a new and unique approach, and have decided to band together and form the Chinese and Spanish Wine Association. The purpose of this association is to promote the culture and improve sales of Spanish wine in China.

The US, New Zealand, South Africa, Chile and Argentina have formed an alliance with a local Chinese partner, Shanghai’s Grapea & co., in an effort to improve the perception of ‘new world wine’ in China (Vinex). The campaign will consist of an online marketing campaign as well as sommelier competitions. The content of the campaign will be available for free on various platforms such as WeChat, Tmall and TikTok, and consists of virtual masterclasses and videos across a range of topics such as history, winemaking, news as well as food pairings for wine. The venture which kicked off in June 2020 is going to run until the end of 2020, providing a platform for these countries to improve their image and presence across China.

How to Get Your Wine to China in 2020

Producers

As a producer intending to participate in the Chinese wine market, you are tasked with finding means and channels to enter the market and ultimately create a demand for your wine. To do so successfully, it is imperative to find the right importer and distributors to ensure your wine can enter legally and be sold on the correct platforms.

For producer’s there are many options that should be taken into consideration, which could enable you to sell your wine in China. A producer first needs to find an importer, who is able to get the wine into China. Although there are thousands of importers, this number is only a fraction of the number of producers there are. As such, the importers are the prospective clients and producers need to compete for their interest.

Producers can connect to importers at wine expo’s, trade fairs or by simply sending them information and samples directly. It is recommended for producers to work with importers and distributors that have experience in their respective fields. Due to the COVID-19 pandemic, this process of finding and connecting with an importer can be done digitally and with a local partner like INS Global, your needs and interests in China will be taken care of.

Wine Importers in China

Importers play an extremely important role in getting your products into China. While there are numerous wine producers around the world, in comparison there are far less importers, making it a challenge for some wine makers to attract the right importers.

Previously in China, around 20 years ago, importation and distribution of all alcoholic beverages was done exclusively by China Oil and Foodstuffs Corporation (COFCO), a Chinese state-owned food conglomerate. While COFCO still remains the largest importer, other importers were also permitted to participate in the market. Now the market is highly fragmented and market share is not exclusively controlled by a single enterprise, but rather by the numerous private importers, who possess import licenses.

When looking for an importer a key consideration is to find someone with good distribution channels. As there is no distributor who covers the entire jurisdiction of China, a producer should seek an importer who has the right channels for regional distribution. However, as there are far less importers than producers, importers are frequently solicited.

Across China there are more than 6,000 importers, all of whom represent different brands and vary in quantity imported. Smaller importers may import as little as 2 or 3 containers a year, while medium sized import around 20 to 60 a year, with anything more being done by large importers. Some importers are also able to handle distribution as well, which make it easier for the producer, however this will depend on the region being targeted.

Here are some of the top wine importers in China (Beverage Trade Network):

- ASC Fine Wines – they represent over 100 wineries and more than 1,200 different wines.

- East Meets West (EMW) Fine Wines – they represent more than 600 wine brands from more than 12 different countries.

- Torres China – Established in 1997, their portfolio extends to exclusively selected wineries from the world’s most renowned wine producing regions.

- Globus Wine Company – they represent over 200 wines most of which are boutique producers.

- Summer Gates – Founded in 1999, they select internationally renowned brands based on strong reputations and a commitment to high quality.

Distributors

Distributors are just as important as importers when it comes to getting your products on shelves, in bars, homes, hotels and restaurants. As stated above, there is no distributor who can provide national exclusivity.

Distributors generally have trouble importing and therefore it is necessary to find an importer before mapping out the distribution of your wine. However as previously mentioned, it is possible to find an importer who also handles distribution.

Distribution Channels

The distribution channels in China differ to the channels in other parts of the world. Finding the right distributor may be a challenging but ultimately rewarding task and there are various ways to go about it. Although success is not guaranteed, with the right distribution channels there is a large possibility your wine could prosper in the world’s second largest market. There are certain steps a producer can take in order to find a distributor.

Different methods to find a distributor:

- Digital Search

This is generally a point of departure for many small producers. Although searching online may prove useful, it can be a very time consuming and frustrating process. The challenging part is finding one online that will take you seriously as distributors may be selective and prefer to opt for high end or high quality products.

- 3rd party distribution company

A number of 3rd party distribution companies are less active on online forums and can be contacted through a connection (word of mouth, through another producer, through a Chamber of Commerce etc.). Sometimes good distributors don’t have the necessary information readily available on the internet, yet locally they have well developed Channels across China.

- Trade Fairs and Wine Shows

Trade fairs and wine shows are a good place to meet importers and distributors or make new connections. It’s possible to attend the trade fairs on your own or get a 3rd party to represent you (We’re able to help you find the representation you need).

It is important to find a distributor who is serious about doing business with you. Often they negotiate the terms of contract and price terms quite shrewdly when intending to conduct business with you. It is also important that you employ the correct means to communicate with a distributor, such as the use of WeChat and a trusted partner who is not only able to communicate in Chinese, but who also understands doing business in China.

The Importance of E-commerce for the Wine industry in China

With the largest e-commerce market in the world, it is a highly important resource that can be used by wineries to ensure their product ends up in the hands and hearts of Chinese consumers. China’s online market place has surpassed that of both the United States and countries in Europe, signifying how important e-commerce is for consumers and businesses alike.

It is estimated that that more than 20% of wine sold in China is done via e-commerce, with this number predicted to sharply increase over the next decade. E-commerce platforms offer a greater reach to more consumers in a faster period than a traditional retail platform could. Platforms such as Tmall, JingDong and Suning have the largest market share in online distribution. Additionally, there are smaller online platforms, that operate within a particular region, which could be the right channel to explore for a particular wine producer.

It is important to note, a one size fits all approach should not be used by any brand wishing to enter China (click here to check out marketing mistakes some brands have made). No matter the product, it’s branding and marketing strategies may require some adjustments, adapting your offerings to the needs and tastes of local consumers.

Notable Wine Events in China

Trade shows and wine expos allow producers, importers, distributors, retailers and other professionals in the industry to come together. These events provide the perfect platforms for professionals to network, buy, sell and promote their products.

With COVID-19 restricting travel and gathering, 2020 has been quite different for all players in the industry and trade shows have been restricted and in some cases cancelled. Organizers have however made adjustments and alternative arrangements for those attending and for those unable to attend. Booths have been set up with a wineries’ branding and products, with the sales person being able to connect with others through video or audio.

Some notable events, as listed by 10times, include:

- ProWine China

- China Wine & Food Fair

- World Bulk Wine Exhibition

- Top Wine China

- China National Food Wine and Spirits Fair

It is also important to note that networking should not only be limited to China, as you may find many distributors and other players attending international wine events such as ProWine in Germany and Wine for Paris in France. Attending these events is not futile by any means, as many players in the Chinese markets attend these events.

The Coronavirus and Wine Industry in China

The spread of the COVID-19 pandemic has significantly shifted the landscape of the wine industry across the world. Imports into China have reduced drastically from the same time in previous years, and for many, the first few months of 2020 have been nothing short of challenging.

Producers are no longer able to freely attend national and international wine events and due to governmental restrictions on the gathering of crowds and social distancing there has even been a reduction in the production of wine.

In China, the first half of 2020 saw a major decrease in the volume and value of wine from countries all across the board. The only country that saw an increase in wine exports to China, during the first half of 2020, is Argentina which had a 590% increase. Australia, Italy and Spain all found themselves on the opposite end of the spectrum having experienced a more than 30% decrease in imported volume, while France suffered a more than 45% decrease.

Although an extreme decline was seen in the first half of the year, many experts expect a big close to the end of the year. Despite the current severity of the global pandemic, producers, importers, distributors and suppliers are now coming up with new, innovative ways to work.

China is making a fast recovery from the impact of the COVID-19 and Chinese consumers are steadily returning to their old purchasing habits.

For those companies, wineries and producers wishing to enter the market at this time, there are a number of challenges that may be faced. With travel bans being imposed, it is almost impossible to setup an entity, as tasks such as signing company incorporation documents, opening bank accounts and going through the necessary interviews, will be delayed for an indefinite period. For those wishing to enter, they may have to explore other options such as the use of a Professional Employer Organization (PEO).

Following the trends, although the wine culture is relatively new in China, it is continually growing at a dynamic pace. Despite the market remaining quite fragmented, there is growing opportunity for new players to enter the market from all parts of the globe. With the growth of the middle class and ongoing exposure to new variations, therein lies opportunity for countries like Spain, Chile, South Africa and New Zealand, to grow their presence. There is also a chance for the larger wine producing nations to introduce more variations and gain a larger share of the market. With China recovering so fast from the virus and growing interest from consumers, now may be the time to consider taking your wine to the Middle Kingdom.

Partner with INS Global

Having a partner in China could be really helpful, during these unique times. Our solutions allow you to hire a sales person or representative located in China, that can help further your business interests. Our team has expertise in array of different HR roles, that are able to take care of your administrative needs, while your representative takes care of your business needs. Get in contact with one of consultants today and let us help you grow your brand in China.

SHARE